Utah Tax Exemption For Military . Deduct the amount of active duty military. military veterans in utah will no longer be taxed on their retirement pay. retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. the state of utah has become the latest to stop taxing military retired pay. nonresident service members do not pay utah income tax on active duty military pay. tax information for military personnel. learn more about the utah active or reserve duty armed forces property tax exemption. On march 11, 2021, gov. the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. Cox signed senate bill 11 into. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. Utah disabled veteran and survivors. The following links give helpful tax information for members of armed forces.

from www.templateroller.com

Utah disabled veteran and survivors. learn more about the utah active or reserve duty armed forces property tax exemption. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. Deduct the amount of active duty military. tax information for military personnel. retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. military veterans in utah will no longer be taxed on their retirement pay. nonresident service members do not pay utah income tax on active duty military pay. On march 11, 2021, gov.

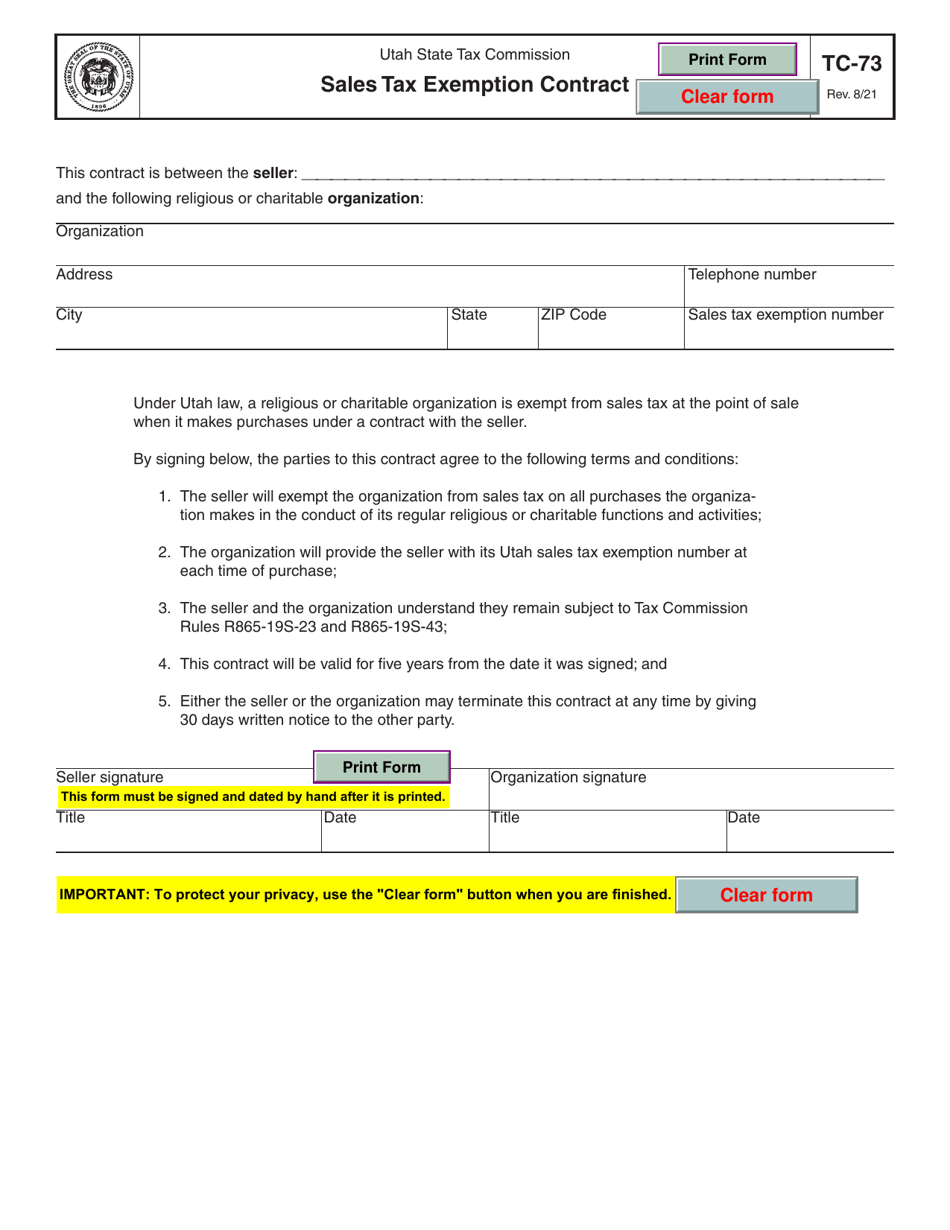

Form TC73 Download Fillable PDF or Fill Online Sales Tax Exemption

Utah Tax Exemption For Military the state of utah has become the latest to stop taxing military retired pay. tax information for military personnel. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. On march 11, 2021, gov. Utah disabled veteran and survivors. military veterans in utah will no longer be taxed on their retirement pay. the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. Deduct the amount of active duty military. learn more about the utah active or reserve duty armed forces property tax exemption. The following links give helpful tax information for members of armed forces. Cox signed senate bill 11 into. nonresident service members do not pay utah income tax on active duty military pay. the state of utah has become the latest to stop taxing military retired pay.

From www.templateroller.com

Form TC721A Fill Out, Sign Online and Download Fillable PDF, Utah Utah Tax Exemption For Military nonresident service members do not pay utah income tax on active duty military pay. Utah disabled veteran and survivors. On march 11, 2021, gov. Deduct the amount of active duty military. Cox signed senate bill 11 into. tax information for military personnel. the state of utah has become the latest to stop taxing military retired pay. . Utah Tax Exemption For Military.

From www.pdffiller.com

Fillable Online Utah Sales Tax Exemption Certificate Fax Email Print Utah Tax Exemption For Military retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. Cox signed senate bill 11 into. The following links give helpful tax information for members of armed forces. tax information for military personnel. the active duty military wages of a native american utah resident are. Utah Tax Exemption For Military.

From www.templateroller.com

Form TC721g Fill Out, Sign Online and Download Fillable PDF, Utah Utah Tax Exemption For Military retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. learn more about the utah active or reserve duty armed forces property tax exemption. military veterans in utah will no longer be taxed on their retirement pay. The following links give helpful tax information for. Utah Tax Exemption For Military.

From www.exemptform.com

Military State Tax Exemption Form Utah Tax Exemption For Military nonresident service members do not pay utah income tax on active duty military pay. Cox signed senate bill 11 into. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. Deduct the amount of active duty military. military veterans in utah will no longer be taxed on their. Utah Tax Exemption For Military.

From www.signnow.com

Blank Utah Tax Exempt Forms Fill Out and Sign Printable PDF Template Utah Tax Exemption For Military the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. Cox signed senate bill 11 into. Utah disabled veteran and survivors. The following links give helpful tax information for members of armed forces. you may qualify for this credit if you or your spouse (if filing. Utah Tax Exemption For Military.

From doeybabbette.pages.dev

Tax Exempt Form 2024 Utah Lacy Ranice Utah Tax Exemption For Military On march 11, 2021, gov. Deduct the amount of active duty military. the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. nonresident service members do. Utah Tax Exemption For Military.

From exoydjjtt.blob.core.windows.net

Utah Tax Forms Instructions at Julie Rubin blog Utah Tax Exemption For Military tax information for military personnel. Cox signed senate bill 11 into. nonresident service members do not pay utah income tax on active duty military pay. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. On march 11, 2021, gov. The following links give helpful tax information for. Utah Tax Exemption For Military.

From www.exemptform.com

Us Army Tax Exempt Form Utah Tax Exemption For Military military veterans in utah will no longer be taxed on their retirement pay. Deduct the amount of active duty military. the state of utah has become the latest to stop taxing military retired pay. retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. Utah. Utah Tax Exemption For Military.

From www.templateroller.com

Form TC160 Download Fillable PDF or Fill Online Application for Sales Utah Tax Exemption For Military On march 11, 2021, gov. military veterans in utah will no longer be taxed on their retirement pay. Utah disabled veteran and survivors. the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. Deduct the amount of active duty military. you may qualify for this. Utah Tax Exemption For Military.

From www.templateroller.com

Form TR601 Download Fillable PDF or Fill Online Military Personnel Utah Tax Exemption For Military the state of utah has become the latest to stop taxing military retired pay. nonresident service members do not pay utah income tax on active duty military pay. learn more about the utah active or reserve duty armed forces property tax exemption. On march 11, 2021, gov. military veterans in utah will no longer be taxed. Utah Tax Exemption For Military.

From www.templateroller.com

Form TC73 Download Fillable PDF or Fill Online Sales Tax Exemption Utah Tax Exemption For Military the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. tax information for military personnel. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. retirees with multiple sources of income will be allowed to. Utah Tax Exemption For Military.

From doeybabbette.pages.dev

Tax Exempt Form 2024 Utah Lacy Ranice Utah Tax Exemption For Military you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. The following links give helpful tax information for members of armed forces. military veterans in utah will no longer be taxed on their retirement pay. Cox signed senate bill 11 into. tax information for military personnel. nonresident. Utah Tax Exemption For Military.

From stepbystepbusiness.com

How to Get an Exemption Certificate in Utah Utah Tax Exemption For Military Deduct the amount of active duty military. the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. The following links give helpful tax information for members of armed forces. On march 11, 2021, gov. the state of utah has become the latest to stop taxing military. Utah Tax Exemption For Military.

From www.formsbank.com

Fillable Form Tc161 Utah Registration For Exemption From Corporate Utah Tax Exemption For Military the active duty military wages of a native american utah resident are exempt from utah tax if the service member joined the. retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. Deduct the amount of active duty military. Utah disabled veteran and survivors. you. Utah Tax Exemption For Military.

From www.templateroller.com

Form TC161 Fill Out, Sign Online and Download Fillable PDF, Utah Utah Tax Exemption For Military retirees with multiple sources of income will be allowed to exempt their military retirement payments from their total income when filing their. nonresident service members do not pay utah income tax on active duty military pay. tax information for military personnel. Deduct the amount of active duty military. Utah disabled veteran and survivors. military veterans in. Utah Tax Exemption For Military.

From www.templateroller.com

Form TC160G Download Fillable PDF or Fill Online Sales Tax Exemption Utah Tax Exemption For Military Deduct the amount of active duty military. military veterans in utah will no longer be taxed on their retirement pay. On march 11, 2021, gov. learn more about the utah active or reserve duty armed forces property tax exemption. Utah disabled veteran and survivors. the active duty military wages of a native american utah resident are exempt. Utah Tax Exemption For Military.

From www.formsbank.com

Fillable Form St102 Use Tax Exemption Certificate New Resident Or Utah Tax Exemption For Military the state of utah has become the latest to stop taxing military retired pay. military veterans in utah will no longer be taxed on their retirement pay. you may qualify for this credit if you or your spouse (if filing jointly) received taxable military retirement pay. Utah disabled veteran and survivors. On march 11, 2021, gov. . Utah Tax Exemption For Military.

From forms.utpaqp.edu.pe

State Of Utah Tax Exempt Form Form example download Utah Tax Exemption For Military the state of utah has become the latest to stop taxing military retired pay. tax information for military personnel. Cox signed senate bill 11 into. military veterans in utah will no longer be taxed on their retirement pay. Utah disabled veteran and survivors. you may qualify for this credit if you or your spouse (if filing. Utah Tax Exemption For Military.